It is impossible to tell the entire story in a few words. Here is more of the story – through the actual documents.

First, here is the Denver Post guest commentary outlining the special district abuse in Solterra and the beginning proposed reforms to be adopted by cities and counties considering the creation of new special districts:

(If the link doesn’t work, here is the pdf version:

Key Resource Documents

1. Here are the Solterra ballot issues “voted” on by the 8 Brookfield employees in 2006 which eliminated the right of the future residents to vote on their own taxes – bond debt. The language is the same once you get to the ballot issues for the “infrastructure”. See for example page 10 (document page 3), ballot issue “F”:

“. . . Such debt to be issued or incurred . . . To be paid by . . . property taxes . . . All of the above as may be determined by the District Board of Directors . . . And shall the proceeds of any such debt . . . Be collected retained and spent by the District as voter approved revenue . . .

First and Only Election Certificate of Election Results, 2006-11-07

2. Here is the most recent example of the notice, issued by the Brookfield attorney, cancelling the election. A similar notice was issued every election year for eleven years. Prior to the recall, there were no elections after the first and only “election” in 2006 (above). This notice was filed each time canceling the election:

Solterra Town Hall Election cancelled 2016

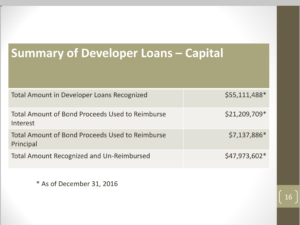

3. Here is the slide from Brookfield’s presentation to the 250 residents “explaining” that the $28 million in checks Brookfield wrote to itself went to pay for $21 million in interest and $7 million for pipe in the ground:

Note, that this $21 million in interest is based upon 6% interest for $63 million in “principle” Brookfield claims it paid for the infrastructure and “loaned” to the residents. That $21 million in interest was just as of December, 2016. The interest is higher today and keeps adding up because they only “paid down” $7 million of the principal. Brookfield says the interest is still running on the remaining $55 million Brookfield says Solterra residents still owe.

4. Here is a sample bond – the language is virtually the same for each. On page 15 you see the bond’s statement of the amount of principal and interest that will be paid over the life of this bond. There are two other bonds, all adding up to a total of $28 million in principal. When the bonds were sold, usually within days of being issued, Brookfield immediately wrote itself a check for the amount of the bond proceeds, again, totaling $28 million.

5. Here is the web site where you can find all the bonds. When you add up the interest, just the interest, for each bond, the total amount of interest the residents are paying adds up to a total of $36 million.

https://emma.msrb.org/IssuerHomePage/Issuer?id=C49A1F4607BD3807D3573CE8EA5A954D

https://emma.msrb.org/IssuerHomePage/Issuer?id=1C0C57C6CCBA95484010EE7906EA3331

The residents are paying interest on interest. $21 million in interest for the “loan” from Brookfield to the residents. That interest was paid by check from Brookfield to Brookfield when the bonds were sold.

Then the residents are paying more interest – $36 million – to repay the bonds which repaid the loan.

So, the residents are paying $36 million in interest on the bonds. They are also paying $28 million in principal on the bond. That $28 million in principal on the bond includes $21 million in interest on the “loan”. Paying interest on interest. And the interest on the “loan” keeps adding up.

Loans and lots of interest with no disclosure to the residents before they bought their homes.

Total interest so far: $21 million plus $36 million equals $57 million. Total principal paid so far: $7 million worth of pipe in the ground.

Where did the money to pay for the lots go – don’t know Brookfield wont’ tell.

How much did Brookfield actually spend – the actual cost – for infrastructure – don’t know Brookfield won’t tell. They told Lakewood the cost would be less than $30 million. And whatever it was, it was likely covered by the lot fees, along with a healthy profit.

6. Here is the agreement Brookfield made with itself to require future residents to pay this “loan”. It was not included in the closing documents when Solterra residents bought their homes.

Solterra Agreement Brookfield Repayment Dist 1

See page 10 for the signatures:

Note the signature for the “District” – on behalf of the residents – is the same as the signature for Brookfield (then “Carma”). Same person.

This is called a single party contract and it is not valid. Why. Because the person who signed for both parties was the same person, had an obvious conflict of interest and acted in bad faith. A Colorado Court of Appeals recently reached this conclusion in the context of a self-serving agreement to exercise eminent domain. https://www.courts.state.co.us/Courts/Court_of_Appeals/Opinion/2017/15CA1956-PD.pdf

See page 19 : “Second, the evidence of bad faith is substantial. We recognize, as the District has pointed out, that in the early stages, special district boards are generally made up of the developer’s representatives. But the representatives, when serving in their capacities as board members, may not take actions based on their own self-interests as the developer. See Geudner, 786 P.2d at 436-37. . . . In other words, the Developer spoke for the District and the District acted for the Developer. . . . The District’s circumvention of the statute reinforces our view that the condemnation proceedings were undertaken in bad faith.”

So, the “loan” is invalid and unenforceable. Yet, the current Solterra board may be taking action as if it was enforceable. When the issue was first raised with their attorney, the response was “thats just the name of the game”, in other words “go along to get along”.

The person signing this invalid loan agreement is the same person who is currently the president of the Big Sky District Board of Directors (there are only two).

7. Finally, here is the language from the bonds that tells the bond investors Solterra residents are really happy to pay all this debt and interest – because they voted on it – but doesn’t tell the bond investors there were only 8 “voters” and they were Brookfield employees. At pages 60 – 61 of the 2016 Bond attached above:

“Various State constitutional and statutory provisions require voter approval prior to the incurrence of general obligation indebtedness by the Districts. . . . At the 2006 Election, the qualified electors for each of the Districts voting at such election approved indebtedness for each of the Districts of $60,000,000 for public improvements in each of 10 infrastructure categories for a total of $600,000,000 in total debt authorization for each of the Districts (excluding refunding authorization), and a maximum repayment cost for such indebtedness of $4,920,000,000 for each of the Districts. . . . . The Districts have also each obtained voter authorization at the 2006 Election for the issuance of indebtedness to refund previously incurred obligations (including at a higher interest rate) in the amount of $120,000,000, with a maximum repayment cost of $984,000,000.”

There is more information and many more documents of course. I am happy to make all my research available to anyone who is interested.

The next step for Solterra is to repeal the 2006 ballot issues and return the power to vote on future debt and bonds to the people – the residents. No future debt should be authorized unless voted upon by the residents at an election.

I will be working on the campaign to begin that process.

John Henderson

jkhjr1@gmail.com