I often receive requests to evaluate a metro district. The Serratoga Falls Metro District for the Kitchel Lake Development is one district and its in trouble.

- Serratoga Falls Metro District 3 is the residential district. It is all built out so the revenue coming in isn’t going to increase except when the assessed value increases.

- They are sending all their money to the Developer District (“Operating District”), District 1.

- The Developer District is spending all of District 3’s money without any input from the District 3 residents.

- The amount of money coming in to District 3 doesn’t begin to cover all the money District 1 is spending “on behalf of” District 3. District 3 can’t afford the Developer District’s spending.

- So the Developer is advancing more money to make up for District 3’s lack of funds. The “developer advance” is a “loan” to the residents, with interest.

- There are two buckets of money

-

- 1 bucket for operations and maintenance – daily expenses

-

- 1 bucket for paying off developer debt

Here is what that looks like in the budget:

- Here is the budget for the resident’s district for operations and maintenance. Income from resident property taxes $82,973. All of it paid to Developer District 1 as an intergovernmental transfer:

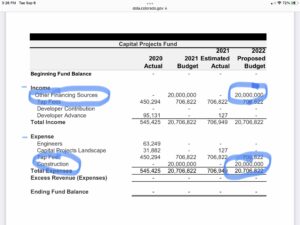

Here is the budget for the Developer District showing the receipt of the residents’ money, the developer advance and the spending well beyond what the residents can afford:

- Expenses: $375,700.

- Income from residents: $82,973.

- Income from Developer loan (to be repaid with interest): $221,201.

Comment by District 3 Manager hired by developer at August 24 meeting (paraphrasing): “its ok to be in the hole without money to pay your bills; it happens to everyone in metro districts. You’ll get more money as the price of the homes (and taxes) increase.”

Its “ok” as long as you aren’t the one in the hole obligated to pay the daily costs of operating and maintaining the district.

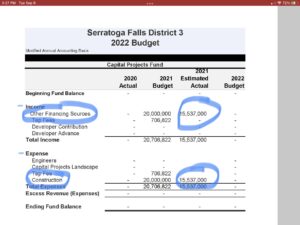

2. Here is the budget for the repayment of the developer debt (assuming it was not already paid with the cost of the developed lot).

This shows the sale of the bonds by District 3 (then controlled by the developer). The proceeds from the sale then paid the developer for his advances and allegedly the cost of construction. It was originally planned to be $20 million but they only sold $15,537,000 (since the Service Plan only allowed $16 million):

Then the $15,537,000 paid to District 3 was paid to District 1 and District 1 paid it to the Developer for “construction”.

- No other detail as to what the money was actually spent on. The District Manager continues to decline to produce the engineer’s report (hired by the developer to say the costs were “ok”).

- And the Developer was on all ends of the deal. The developer was the board for District 3, District 1, was the developer getting paid AND as we will see below, is also the person who bought all the bonds.

Here is the Budget for District 1 showing receipt of the $15,537,000 and payment to himself (developer). Note that at the time of this budget the amount was still $20,000,000; not the reduced $15,537,000 (it is interesting that the developer thought he could issue $20 million in bond debt when the Service Plan was limited to $16 million).

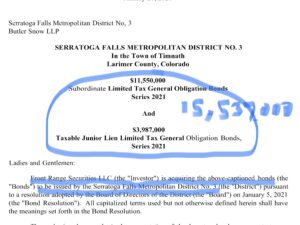

Here are the documents showing that the “bond” issued by District 3 (when it was still all developer board members) was “sold” to himself, the developer.

- So, the developer created a “loan” to the residents for his advances to build the infrastructure (again assuming it was not already paid for in the cost of the lot – which it probably was).

- The residents had this “debt” to pay, with interest.

- Then District 3 (still the developer) “cashed out” and sold the bond to . . . Himself . . . .

- And now the residents are paying interest on the bonds which paid for interest on the developer advances. Interest on interest.

- And there is still no check and balance on what the developer advances actually paid for. Potentially more developer profit – particularly if the costs of infrastructure were already paid for with the cost of the lot.

Here is an excerpt from the “bond” document:

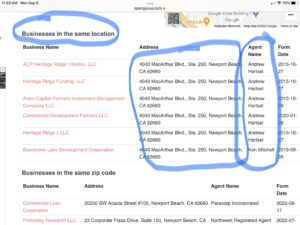

So, who is Front Range Securities, LLC and who is their registered agent.

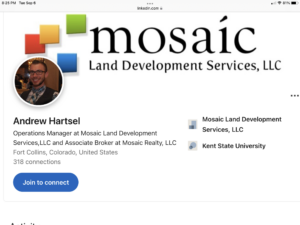

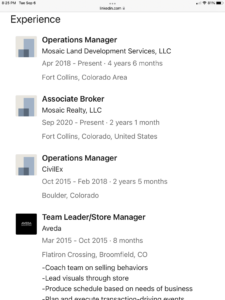

The information did not list the registered agent which is unusual. But it did list the many companies headquartered at the same exact address. The registered agent for all those companies was Andrew Hartsel and, for the last one, Ken Mitchell.

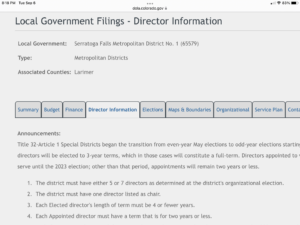

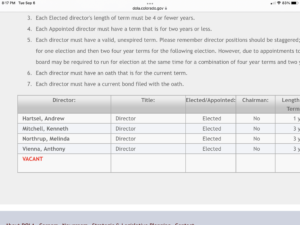

Andrew Hartsel is employed by the developer for Kitchell Lake (Mosaic). He was president of District 3 and still is president of District 1. Mitchell is also on District 1:

BOTTOM LINE FINANCES:

- Operations and Maintenance

- The residents are paying a total of 50 mills in property tax for both Operations/Maintenance and Developer Debt repayment pursuant to the Service Plan.

- 10 mills are for operations and maintenance right now.

- That is generating $82,973

- But the costs are $375,700.

- This means the residents will have to pay more in taxes or fees. This will require the board asking permission from the City.

- The resident lots are all built out but there may be some lag in the tax payments. This may help a little.

- It is not “alright”, as the District Manager argued, that the district is so upside down and totally dependent on additional loans with interest from the developer.

- Paying the developer less money for the developer debt is another source of income. Right now District 3 is paying every nickel of their tax revenue to District 1, the Developer District and District 1 is making all the decisions on how to spend that money. That must end soon for the residents to have any control over their own taxation and spending.

2. Developer Debt

- District 3 is paying the remaining 40 mills in property taxes District 1 for the Developer Debt payments – the bond payments.

- Pursuant to the Service Plan, the amount approved for developer debt is $16 million. District 3 (when it was controlled by the developer) has already issued $15,537,000 in debt.

- They will have to get permission from the City to issue more debt (more than $16 million).

- BUT THAT IS LESS THAN HALF THE STORY.

-

- The $15,537,000 is just the principal

-

- THE TOTAL DEBT – PRINCIPAL AND INTEREST IS AT LEAST $36,200,817.00

-

- THE TOTAL REPAYMENT AUTHORITY (IF THE AMOUNT IS REFINANCED AND THE PAYMENT TIME PERIOD EXTENDED REQUIRING EVEN MORE INTEREST) IS $1.4 BILLION.

-

- $1.4 BILLION WAS APPROVED BY THE 5 INITIAL DEVELOPER “VOTERS” WHEN THE DISTRICT WAS CREATED – AT THE SAME TIME THE RESIDENTS’ RIGHT TO VOTE ON TAX AND BOND DEBT WAS TERMINATED

-

- There was no permission from the City to approve a debt repayment (principal and interest) authority of $1.4 Billion.

-

- The 5 developer voters also voted to approve “principal” in the amount of $22 million (ten times) which is probably why the developer initially thought he could issue a bond of $20 million – he was following his own vote, and not the limit set by the City.

- THE CURRENT ACTUAL DEBT (PRINCIPAL AND INTEREST) DIVIDED BY THE REPORTED NUMER OF HOMES IN DISTRICT 3 (250) IS:

- $36,200,817 divided by 250 = $144,803.27 on average per household. Some will pay more; others less. This is the average per household.

- Paid out at 44 mills (with the Gallagher adjustment) per year for up to 40 years.

- As noted above, the “bond” is essentially a direct loan from the developer. He bought the bonds to pay himself.

- The residents should be able to negotiate

- for a lower amount and

- require actual cost verfication for what the money paid for and

- require actual documentation showing how much was paid for the lots and where that money went.

- the developer entered into an agreement with himself to make the loans to the residents with interest, then entered into an agreement with himself to pay off those loans with a bond issue. And he entered into an agreement with himself to purchase those bonds collecting more interest. All contrary to the best interest of the residents, especially if they already paid the infrastructure costs in the price they paid for the developed lot.

- This negotiation would be the first time the residents had anything to say about it since

- they had nothing to say about the metro district “finances”

- before or when they bought their homes and

- had no actual notice of this “loan” and debt burden.

BOTTOM LINE DISTRICT MANAGEMENT

- One of the current board members recruited two other residents to self-nominate and for the first time in May, 2022, the board had a majority of residents.

- The board attorney, who of course was and still is representing the developer, resigned due to a conflict of interest

- Unfortunately the board still has a developer employee on the board. And two of the resident board members disagreed with one board member asserting that in their opinion the developer could participate and vote unless he recused himself – leaving it up to the developer to decide whether or not he had a conflict and would withdraw, contrary to CRS 24-18-109.

- The developer employee decided it was ok for him to participate in deciding who the new attorney should be and his vote was the deciding vote. (Original vote was two residents for one attorney and developer and another resident for a developer favored attorney. With the tie, one of the residents changed their vote to support the developer favored attorney.) In essence, the developer chose the attorney to represent the residents.

- The new law firm also represents District 2, which was not disclosed. And the new law firm was the former attorney for the Amber Creek District where there are allegations and supporting emails regarding the firm’s involvement with the engineer who allegedly provided false information to the City claiming false costs by the developer to support an increase in the debt limit.

See: Amber Creek Article and Amber Creek Brief 2022 and 2022-08-12 19-31-16 Amber Creek — 12(b)(1) Reply to Motion to Dismiss

- Compounding the management challenge is that the developer-hired management company who also manages District 1 for the Developer

- Is running the District 3 meetings

- Is limiting one resident board members’ access to information

- prepared and promoted the developer analysis showing how the residents will ultimately be able to afford all the costs through the increased value in their homes

- solicited and promoted selection of the developer preferred attorney

- otherwise advocates the developer positions (i.e. recent memorandum of understanding prequel to a new intergovernmental agreement with District 1)

- has a conflict of interest representing both the developer district (District 1) and the resident district (District 3)

Hopefully the resident board members will find their voice and anchor their decisions in the documents and actual finances. The district’s future is in their hands.

If I had a choice, in my opinion based upon evaluating dozens of districts, including my own (Solterra) and devoting 5 years of research and advocacy for metro district reform, I would want to wait and see what develops in the next 5 years before making a commitment to purchase in this community. There is a lot of unaccounted-for debt and apparently more coming. And the developer is still in control of the obligations that require taxing as well as the actual spending.

John Henderson

I live next to Kitchel Lake District 1 and 3.

Residents in Kitchel Lake are being told the pool and club house will not be built.

My Metro District (near Kitchel) developer is no longer involved, he went bankrupt and we were taken over by a landholding company which left us with a large debt. Our management has an issue with integrity. They provide fabricated reports to the DRC regarding fines imposed and fines paid. Even say the court house lost the liens they took to be filed.

In general choosing what to manage, not what the Board and DRC and then literally have a string of lies about what work they performed. This is going on for years, so why would anyone want to volunteer?