The Kitchel Lake developer and management company are covering their mismanagement of this metro district by proposing to charge a $1,000 “fee” this year and a potentially higher fee in subsequent years from each homeowner. The homeowners are paying about $1,300 in metro district taxes already.

On November 30, 2022 at 5:30 pm the board of directors will decide the final amount of the annual assessment. One of the board members works for the developer and it appears that a majority of the remaining board members support the developer and his management company. See below for the meeting zoom and location.

Here is a detailed analysis of this metro district from a few months ago, September 6, 2022:

Kitchel Lake (Serratoga Falls Metro District) Case Study of Metro District Abuse

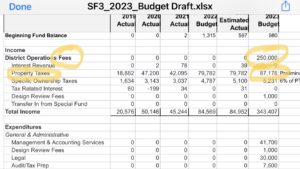

Here is a summary of the numbers for the 2023 budget:

- $336,371 2023 Cost of operations

- $87,176 2023 Tax Revenue for operations

- $249,195 2023 Deficit

- $250,000 2023 New Assessment ($1,000 per

household)

Here is a screen shot from the proposed budget showing the increased fee of $250,000, and the income from property taxes ($87.176):

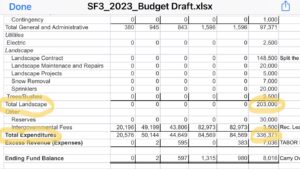

Here is a screen shot from the proposed budget showing the amount of expenditures. Note the amount for landscaping:

Note that the homeowners are paying much more in property taxes. They pay 11 mills for operations and maintenance which equals the $87,176.

BUT they are also paying an additional 45 mills to the developer to “repay his debt”, for which the accounting is limited if not non-existent. That number is $348,718.

All or part of these tax dollars could potentially pay for operations and maintenance instead of “developer debt”.

This amount pays for principal and interest on money the developer loaned himself to allegedly build the infrastructure. The residents are paying the bill in addition to the money they already paid for the infrastructure in the cost of their developed lot paid as part of the cost of the home.

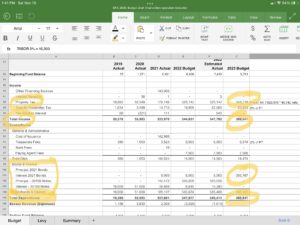

Here it is in the budget. The developer took all the remaining money the homeowners paid in property taxes to pay a portion of the “developer debt”

ew

ew

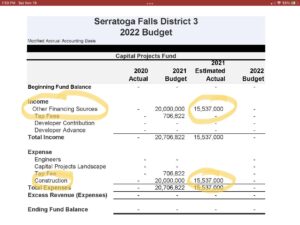

And here is what the accounting for that “developer debt” looks like in the budget when the “loan/bond” was created by the developer board and current management company.

- The money “paid” to the district from the “loan” from the developer

- is then immediately paid to the developer for “construction”.

- Note as documented in the blog referenced above, the bond holder (loaning the money to the district to pay the developer), IS THE DEVELOPER.

- This unregulated self-dealing is very expensive to the homeowner. The residents are paying significant interest on money the developer loaned himself to allegedly pay for infrastructure.

Here is the proposed budget in its entirety:

SF3_2023_Budget Draft (final edition operation fees)

How did the developer board and their management company spend more than the residents could afford. Simple. They underestimated the cost of operations and maintenance and overestimated the amount of tax revenue when they presented the Service Plan to the City for approval. They represented that the money generated by the property taxes would be enough to pay the bills. It never was. It never will be. This is not the result of increased costs.

Here are the estimates “certified” by the developer board and their management company. These numbers were used to support the issuance of debt and establish that the residents could afford the cost of the operations and the debt:

26 Cash Flow (Based on Market Study)_57172783_1

It appears that the developer built amenities that the residents could not afford. Thereby attracting homebuyers to the development with no warning that there would be surprise ballon payments to pay for the amenities after they moved in.

In other words, spend freely on marketing the properties until they are sold. Once they are sold, send the marketing bill to the new residents to pay.

It is also possible the developer was and still is charging the residents for his own overhead as operations and maintenance.

Only an in-depth analysis by an expert loyal to the residents will be able to identify exactly what went wrong. But that is unlikely to happen with the current make up of the board. A majority of the board appear to be either employed by the developer or supportive of the developer and his management company.

The residents are already paying a lot of money in taxes. 55 mills is roughly the maximum average. They should not have to pay even more in fees.

An in-depth evaluation of the “loan” and monies actually paid for the cost of the developed lot and monies actually spent by the developer on District 3 – only – infrastructure will also help determine whether or not the residents should be paying $348,718 a year and more for “developer debt”. All or part of that money spent on “developer debt” could be used to pay for the cost of operations and maintenance subject to the residents’, not the developer’s, oversight.

The management company earlier brushed aside the significant deficit as common in metro districts. Their current message to the homeowners similarly reports:

“Therefore, it is unfortunate for us to realize the revenues generated by the operating mill levy are insufficient to cover operating and maintenance expenses. Though disappointing, this is not uncommon for other metropolitan districts across the state.

Notably, the WildWing Metropolitan District also located in Timnath recently imposed a $1,000 annual fee to cover shortfalls in revenues generated by the Operations and Maintenance Mill Levy.

Close to half the Districts managed by CCG implement an annual fee to cover inadequate operations mill levies capped by the Districts’ Service Plan.”

From my research this level of mismanagement is NOT common. Instead, it is more of an indictment of this management company and developer’s practices and abuse of metro district financing.

The residents have choices about who manages their tax money. Now would be an appropriate time to exercise that power and those choices.

The state authorities and the city are not regulating these abusive practices. The only check and balance are the homeowners. If they want to change the management of their tax dollars, they have to do it themselves.

Here is the contact information for attending the zoom budget and fee assessment hearing:

The upcoming Serratoga Falls District 3 Board of Directors meeting will be held on Wednesday, November 30th, 2022 at 5:30 PM and will include the Budget Hearing. This meeting will be held virtually and can be accessed via the Zoom instructions below:

https://us02web.zoom.us/j/85390201526?pwd=RkFvSnFyL09pbVJPUThUVVJweTlmZz09

Join by Phone: +1 719 359 4580

Meeting ID: 853 9020 1526

Passcode: 960075

John Henderson