Cardel Homes applied for a metro district at Indigo in Rooney Valley in 2018. It was denied.

Based upon the new application it should be denied again.

It is scheduled for a hearing and decision by the Lakewood City Council July 24, 2023 (next month) at 7:00 pm.

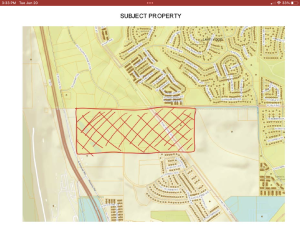

Developers apply to the City of Lakewood to create a new government – a “metro district” – to tax and spend tax income by filing a proposed Service Plan. Cardel has filed a proposed Service Plan for their Indigo development just south and west of Solterra. North of the current Red Rocks Centre development.

The proposed Service Plan is linked below.

Here is why it should be denied. The proposed Service Plan contains several metro district abuses which

- will create significant debt

- on unsuspecting residents and

- eliminates any control by those residents over whether or not they enter into that debt.

In particular,

- There is no prohibition on the developer voting to approve a ballot issue to eliminate the residents’ right to vote on issuing bond debt and increasing taxes

- There is no prohibition on the developer voting to approve a ballot issue to increase the authorized debt limit higher than the debt limit approved in the Service Plan

- The Service Plan authorizes up to 18% interest on debt

- There is no limit on the amount of fees the developer can impose on the residents for operations and maintenance.

- There is no limit on the amount of the mill rate (taxes) that can be imposed by the developer on the residents to pay for operations and maintenance

- The Service Plan allows unlimited mill rates for debt service

- The term of 40 years for debt is too long. The standard is 30 years.

- There is no provision for notice to the residents that the developer has a conflict of interest with the residents regarding taxing and spending of residential money (taxed by and paid for the developer), the developer employees only serve on the district boards because residents have not self-nominated to be appointed or elected, here is the form and where to send it to be appointed or elected to the board.

- Creating a metro district before Cardel has sewer for the site is premature

- Cardel has failed to show how the income from sale of the developed lots won’t cover the cost of the land, cost of the infrastructure and at least 30% profit to Cardel

-

- Cardel has the burden under the statute to prove there is a need – that they won’t cover their costs and profit by selling the developed lots

-

- This application for a Service Plan approval and creation of a new government fails to meet that burden

First, what are the key elements of Service Plans.

- what kind of district is it – library, water, sanitation, recreation. In this case a “metropolitan” district – tax residents to pay for infrastructure (normally included in the cost of the developed lot and paid for when you buy your home – except in Colorado)

- what is the territory – boundary – of the district. In this case a little south and west of Solterra

- Limitations on financial burden imposed on residents. In this case, the limitations are lacking.

(Title 32 – 32-1-202 (2) contains the detailed list of required contents.)

Evaluation of Cardel Indigo Service Plan – Detail

1. First paragraph is very misleading. It indicates the City has no power to limit the metro district power and impose accountability.

In fact, under Title 32 the City has virtually unlimited power to impose restrictions and require accountability.

Here is what the proposed Service Plan states:

“The District is an independent unit of local government, separate and distinct from the City, and, except as may otherwise be provided for by State or local law or this Service Plan, its activities are subject to review by the City only insofar as they may deviate in a material manner from the requirements of the Service Plan.”

In fact, Lakewood has the authority to:

- conditionally approve the creation of the district

- contingent upon providing any information the City may require, as often as it is requested.

- In other words, the City could require approval of every financial decision until the residents arrive and assume their seats on the board of directors ready to make the decisions on how to tax and spend their tax revenue.

-

- The reason this is a good idea of course is because until the residents have all the seats on the board, the developer, who has a conflict of interest with the residents as expressly recited in every audit, will be making all the decisions about how much to tax and spend the resident’s income – all of which is collected to pay money to the developer.

-

- In other words, until the resident have all the seats on the board, the developer is taxing the residents as much as he wants to be paid with no input by the residents and no genuine accountability for how that money is spent.

32-1-204.5 (1), 32-1-202 (2), 32-1-203(2), (2.5) and (3), 32-1-207

2. There is no “need” to create a metro district.

Title 32 requires that Cardel prove there is a “need” for the district. Here is what Cardel says in its Service Plan:

” B. Need for the District.

There are currently no other governmental entities, including the City, located in the immediate vicinity of the District that consider it desirable, feasible or practical to undertake the planning, design, acquisition, construction, installation, relocation, redevelopment and financing of the Public Improvements needed for the Project. Formation of the District is therefore necessary in order for the Public Improvements required for the Project to be provided in the most economic manner possible.“

This says there is a “need” because there is no one else to build the infrastructure (public improvements – the pipes in the ground).

But that is nonsensical because the developer does that – build the infrastructure – not the City or any other government. They always have.

And the developer will build the infrastructure – the pipes in the ground – with or without a metro district. They do it all the time, every time. That is what they do.

The only question is how do they make the money back – pay all their costs – plus a profit.

The developer has the money from a bank, his own capital or a group of investors. He uses that money to buy the land and put the pipes in the ground (and all the related expenses).

- In most of the rest of the country and before metro districts were created in 1982 in Colorado, the developer buys the land, puts the pipes in the ground and sells the “developed lot” to the homebuilder.

- The homebuilder builds the house on top of the land and pipes in the ground. He then sells the house, land and share of the cost of the pipes in the ground to the homebuyer. Along with profit to the developer and homebuilder.

And that still happens. The residents of Indigo will pay for the developed lot which will include the cost of the land, share of the pipes in the ground and profit to the developer.

Just like when the Solterra residents did and paid over $75 million profit just on the purchase of the developed lot before metro district financing.

See, Final CostNarrative.word4

Final Exhibits to Lot Analysis

Metro districts make the developer a whole lot more profit than doing it the traditional way.

So, under Title 32, Cardel must prove that there is a “need” for a metro district. They must prove that the cost of the developed lot – which will be charged to the homebuilder and ultimately the homebuyer – will not cover the cost of the land, pipes in the ground and significant profit to Cardel.

It’s pretty simple. If Cardel gets paid for the land, infrastructure and profit when they sell the developed lot, then there is no need for a metro district.

Particularly when a metro district is so expensive. Paying for infrastructure through a metro district will cost much more than paying for it through the cost of the home. Two loans. Interest on interest. For, in this case, at least 40 years.

3. Cardel does not have Sewer yet for the Development – approval of a metro district is premature until they have sewer

The proposed Service Plan correctly points out that there is no reason to create a metro district until sewer is available and right now, sewer is not available.

” It is anticipated that sanitary sewer service to the property within the District will be provided either by Metro Water Recovery (formally known as the Metro Wastewater Reclamation District) (“Metro”) or Green Mountain Water & Sanitation District (“Green Mountain”) pursuant to one or more intergovernmental agreements among them, however the final means and parameters of such service have not been finalized as of the date of this Service Plan.”

“The City will not approve any Approved Development Plan unless and until sanitary sewer service to the property within the District is obtained.”

(p. 6)

Cardel needs to wait until sewer is available before creating this new government for a new development that is missing a key part of its plan – sewer.

What’s the rush. What are they worried about.

Here is Cardel’s response, from the Service Plan:

“The organization of the District prior to finalizing the plans for sanitary sewer service to the property within the District is necessary because the District will be the entity responsible for entering into the sanitary sewer service and facility agreement(s) in order to secure such service. Without the prior organization of the District, there will not be any appropriate entity in existence to enter into any such agreement(s).”

Of course this is refuted by Cardel and other developer’s legal claims in the Big Sky litigation claiming that they had will serve letters or “promises” of service (without being a metro district). They claimed they had guarantees of service. But they weren’t metro districts. Now Cardel claims it can’t get service without being a metro district. Not true.

Developers get “will serve letters” or binding agreements all the time from sanitation districts to provide service – without an IGA and without being a metro district.

Indeed, Cardel got an assurance for water without being a metro district.

IGAs are contracts between two governments. Contracts between a government and developer are contracts. They’re both contracts. One form of contract isn’t necessarily better than another. And you can enter into that contract whether or not you are a government. Nothing magical about an “IGA”.

(In fact since IGAs are created by governments and governments can change their minds, IGA’s are actually a little riskier than contracts with a private party such as a developer since there are two governments, doubling the risk of change with every election. )

You don’t need to create a metro district to obtain sewer service. Its simply a false assertion.

Cardel also argues the City could go ahead and create a new metro district government, but just withhold the authority to issue debt until Cardel gets sewer:

“The City will not approve any Approved Development Plan unless and until sanitary sewer service to the property within the District is obtained. As a result, the District must secure adequate sanitary sewer service before it may issue any Debt or impose a mill levy or fees for Debt. This strict limitation assures that sanitary sewer service will be obtained before the property in the District, and any future property owner or resident, will incur any significant financial obligation.”

But, the whole point of creating a metro district is to issue debt. So if you can’t issue debt, there is no need for a metro district.

Again, Cardel needs to wait until they have sewer before creating a metro district.

Why create a new government that can’t do what it’s supposed to do until you have sewer and then make it contingent on getting sewer. There is a reason your head is spinning.

Again, whats the rush. Nothing can happen without sewer.

Note there are other options for sewer as well. Mt. Carbon is providing sewer to Red Rocks Centre, immediately to the south. Right next door. And Cardel’s property was part of Mt. Carbon’s district to begin with. So in addition to getting it from Metro Water Recovery, they can also get it from Mt. Carbon.

Cardel is still promoting the Big Sky IGA idea of having Big Sky be the “master meter” for Rooney Valley sewer. A developer selling sewer to other developers in Rooney Valley for a profit:

“It is expected that the District will work cooperatively with one or more of Big Sky Metropolitan District Nos. 1-7 (“Big Sky”), which are located adjacent to the District’s boundaries, in order to plan, design, finance and construct the regional sanitary sewer facilities necessary to obtain such service for the property within their respective boundaries from either Metro or Green Mountain.”

“It is anticipated that following construction of the sanitary sewer improvements necessary to provide service to the property within the District, with the exception of a lift station that may be owned and maintained by the District and/or Big Sky pursuant to an agreement among them, all sanitary sewer improvements will thereafter be owned, operated and maintained exclusively by either Metro or Green Mountain, whichever is the ultimate sanitary sewer provider.”

It is interesting to note here that this statement is the opposite of what Big Sky and the developers argued recently before the Colorado Court of Appeals. They argued before the Court of Appeals that they, the developers and Big Sky, would own, operate and maintain the sewer system, not Green Mountain. Here they say Green Mountain (or Metro) will.

4. Debt Limits

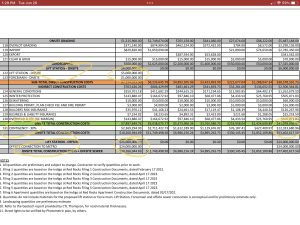

The Service Plan contains a proposed financial plan showing the direct costs for putting the pipes in the ground are about $38.6 million for 735 homes. Adding the soft costs (lawyers, overhead) $41 million for 735 homes.

That is close to the industry average in Colorado of $30,000 – $40,000 per lot. About $52,000 – $55,000 per lot.

Add that to the cost of the land and subtract it from the amount the developer charges for the developed lots will give you the developer profit – before metro district financing.

These numbers need to be verified by the City in order to determine whether or not there is in fact a need for a metro district.

If the developer is already paying himself for the land, cost of the pipes in the ground and at least a 30% profit when he sells the developed lot, there is no need for a metro district government to allow him impose high taxes on residents just to pay him more profit.

Note that later in the Service Plan, Cardel suggests the cost of the public improvements is not $41 million but $77 million:

“An estimate of the costs of the proposed Public Improvements which may be planned for, designed, acquired, constructed, installed, relocated, redeveloped, maintained or financed was prepared based upon a preliminary engineering survey and is, with contingency, approximately $77,402,617.50”

But that amount not only includes an overhead charge, but also a “30% contingency” plus $24 million for Big Sky’s lift station ($5 million is already budgeted in the $41 million for Cardel’s lift station) outside the Indigo district.

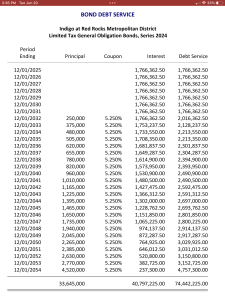

Here are the numbers from the financial plan attached to the proposed Service Plan:

(Again I recall that an argument was made at one point in the Big Sky litigation that there was no need for a lift station)

$77.4 million is clearly an inflated number. $38 – $41 million is the accurate cost of the infrastructure covered by the $42 million debt limit.

The proposed Service Plan proposes a debt limit – how much the developer can collect, just in principal, to pay for the infrastructure – $42,500,000.00

“The District shall not issue Debt in excess of $42,500,000,”

(p.10)

“The total Debt that the District shall be permitted to issue shall not exceed $42,500,000 and shall be permitted to be issued on a schedule and in such year or years as the District determines shall meet the needs of the District to serve development as it occurs. The total Debt authorization is supported by the Financial Plan attached to this Service Plan as Exhibit E. All bonds and other Debt issued by the District may be payable from any and all legally available revenues of the District, including general ad valorem taxes and Fees to be imposed upon all Taxable Property within the District.”

(p.13)

5. Unlimited Fees

The proposed service plan initially makes it sound like no fees are allowed unless approved by the City. But reading it closely, the fees for operations and maintenance of the district are UNLIMITED.

Fees typically aren’t allowed to be charged to pay debt. But in this proposal they are allowed – with the permission from the City.

So the so called limits on fees are not limits at all. There are unlimited operations and maintenance fees plus fees are also allowed to be imposed to pay debt. Only the fees to repay debt require permission from the city.

This is important because what typically happens is that the developer maxes out the residents’ taxes on debt and there is nothing left over to pay for operations and maintenance. So they hit the residents with high fees. The high fees – another $1,500 to $2,000 per year for example – can equal another 35 or more mills of tax burden on top of, in this case, 65 mills of taxes. So when the fees are added, the value of the actual “tax” (including fees) can be over 100 mills.

Here is how they “say it” in the proposed Service Plan:

“19. Fee Limitation.

The District may impose and collect Fees as a source of revenue for District operations and maintenance expenses. The District may impose and collect Fees as a source of revenue for repayment of debt and/or for capital costs, only with the prior approval of the City.

. . . Notwithstanding any of the foregoing, the restrictions in this definition shall not apply to any Fee imposed upon or collected from Taxable Property for the purpose of funding operation and maintenance costs of the District.”

6. Service Plan Proposes Up to 18% Interest on Any Debt

“The interest rate on any Debt is expected to be the market rate at the time the Debt is issued. In the event of a default, the proposed maximum interest rate on any Debt is not expected to exceed eighteen percent (18%)”

No further comment.

7. Tax Mill Rate “Limit”:

Unlimited mill rate for operations and maintenance.

Potentially unlimited for debt.

Here is the favorite convoluted way the attorneys currently try to “limit” the mill rate. They basically say its 50 mills until the amount of debt is less than 50% of the amount of assessed value. Then it’s unlimited. But what they never say is whether that is current assessed value or projected assessed value. And who decides.

The City needs to cut through the legal mumbo jumbo (thats a legal term) and simply say the limit is 50 mills. Period.

Here is how the Service Plan says it:

“For the portion of any aggregate Debt which exceeds fifty percent (50%) of the District’s assessed valuation, the Maximum Debt Mill Levy for such portion of Debt shall be fifty (50.000) mills less the number of mills necessary to pay unlimited mill levy Debt described in Section VI.C.2 below . . .

2. For the portion of any aggregate Debt which is equal to or less than fifty percent (50%) of the District’s assessed valuation, either on the date of issuance or at any time thereafter, the mill levy to be imposed to repay such portion of Debt shall not be subject to the Maximum Debt Mill Levy and, as a result, the mill levy may be such amount as is necessary to pay the Debt service on such Debt, without limitation of rate.

3. For purposes of the foregoing, once Debt has been determined to be within Section VI.C.2 above, so that the District is entitled to pledge to its payment an unlimited ad valorem mill levy, the District may provide that such Debt shall remain secured by such unlimited mill levy notwithstanding any subsequent change in the District’s Debt to assessed ratio. All Debt issued by the District must be issued in compliance with the requirements of Section 32-1-1101, C.R.S., and all other requirements of State law.”

(p. 14)

There is no limit to how high the mill levy can be for operations and maintenance:

“The District may impose a mill levy on taxable property within its boundaries as a primary source of revenue for operations and maintenance. The Maximum Debt Mill Levy for the repayment of Debt shall not apply to the District’s ability to increase its mill levy as necessary for provision of operation and maintenance services to their taxpayers and service users.”

(p. 16)

8. 40 Year “limit” on Paying Debt – Unless Residents Refinance the Debt to a longer Term

30 years is the standard. This Service Plan proposes 40 years.

In many districts the interest is so high that the residents refinance to get lower interest rates but keep extending the term out another 30 (0r 40) years so the debt is perpetual.

“D. Maximum Debt Mill Levy Imposition Term.

The District shall not impose a levy for repayment of any and all Debt (or use the proceeds of any mill levy for repayment of Debt) on any single property developed for residential uses that exceeds forty (40) years after the year of the initial imposition of such mill levy unless a majority of the Board of Directors of the District are residents of the District and have voted in favor of a refunding or refinancing of a part or all of the Debt and such refunding or refinancing will result in a net present value savings as set forth in Section 11-56-101, et seq., C.R.S.”

(p. 14)

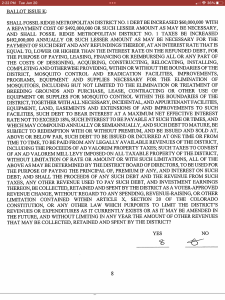

9. TABOR “Compliance”

Here is what virtually every Service Plan says about your TABOR right to vote on issuing tax debt and limits on government spending:

“H. TABOR Compliance.

The District will comply with the provisions of TABOR.”

And in every case, the developer “complies” with TABOR by having an election soon after the Service Plan is approved. At this “election” everywhere from 1 to 8 members of his family or employees sit around a table eating pizza and “vote” to eliminate your TABOR rights. Under TABOR, you can do that. That is “complying” with TABOR.

But of course, TABOR meant people voting who lived there and paid the taxes that were being imposed. The developer will do neither. And he has an explicit (stated in every audit) conflict of interest with those whose vote he is eliminating.

- Cardel will “vote” to eliminate residents’ right to vote on tax increases or issuing bond debt.

- Cardel will “vote” to increase the debt limit to usually 10 times the limit authorized in the Service Plan. And thats just the principle. In Solterra the final authorization they voted on was $4.9 billion.

- Cardel will also “vote” to authorize an interest rate on any debt the developer imposes on the residents of up to 18%.

This is one of the most egregious abuses. The City must:

- Require pre approval of all ballot issues

- Prohibit any ballot issue that increases the debt authorization beyond what is allowed in the Service Plan

- Prohibit any ballot issue that eliminates the right of the residents to vote on tax increases and bond debt.

- Prohibit any ballot issue that sets an interest rate on the bond debt. (The city can authorize the interest rate based on current municipal financing rates at the time a district intends to issue bond debt)

Here is what the ballot issues looked like for Solterra:

There are 10 ballot issues like the one here so the total repayment authorization (credit card limit the developer votes for himself with the residents paying the bill) is $4.9 billion.

10. Disclosures to Residents

Recent reform efforts have generated some improvements but the disclosures to residents are still grossly deficient.

For example, here is how the proposed Service Plan intends to convey information to new homebuyers:

“The District will use reasonable efforts to assure that all developers of the property located within the District provide written notice to all purchasers of property in the District regarding the District’s mill levies and Maximum Debt Mill Levy, as well as a general description of the District’s authority to impose and collect Fees”

(p. 18).

The City should require the disclosure be issued at the time of first contact in the show room, again at the time the contract is proposed, again at the time of disclosures and again at the time of closing.

The City will approve the disclosure.

Here is the disclosure proposed by Cardel (last page of the proposes Service Plan)

- It states the mill rate is unlimited for operations and maintenance but doesn’t say the fees are also unlimited.

- It does not state that the developer “voted” to eliminate the resident’s right to vote on tax increases and issue bond debt.

- It does not state that the developer “voted” to give himself an authorization to impose debt on the residents up to an amount (in the ballot issue) which is higher than the amount authorized in the Service Plan.

- It does not state the interest rate on debt is up to 18%.

- It states the term of debt is up to 30 years, not 40 years.

- It does not show how much will be paid for the developed lot, the cost of the land and infrastructure per lot and the developer profit per lot just from the cost of the developed lot.

- It does not explain that the residents have a right to serve on the district board as soon as they have a contract to purchase a home.

- It does not explain that the developer has a conflict of interest with the residents and will be making decisions about taxing and spending the residents’ money with no accountability to the residents until the residents replace them on the board.

- It does not explain that the only reason the developer may sit on the board is because no residents self-nominated to be elected or appointed to sit on the board.

- It does not explain how much the resident will pay in principal and interest on $42.5 million over 40 years per lot.

11. Elections

The proposed Service Plan’s provision on issuing self-nomination forms for elections to the Board of Directors is vague. The cite to 1-13.5-501(1) is misleading since there are several other sections of 501 which will apply.

The Service Plan should clearly require compliance and City oversight in complying with CRS 1-13.5-501. Failing to comply with this statute has been a significant area of abuse.

Here is how it is phrased in the Proposed Service Plan:

“In addition to any and all notices required by law, the District shall cause written notice of all regular District elections after the District’s organization to be mailed to each mailing address within the District’s boundaries concurrent with the District’s publication of a call for nominations for the election as required by C.R.S. § 1-13.5-501(1).”

(p. 18)

Also, the provision in the Service Plan about providing notice to residents of a vacancy on the board only goes part way. It should require that the notice include a self-nominating form with instructions on where to send it in order to be considered for appointment to the Board to fill the vacancy.

Here is that current provision:

“In the event there arises a vacancy on the Board of Directors at any time, the District shall cause written notice of such vacancy, or vacancies, to be mailed or sent by electronic mail to all residents within the District’s boundaries prior to filling such vacancy(ies)”

Here is the proposed Service Plan and attachments. When you review the plan for issuing debt, you will see how the delay of paying principal increases the amount of interest paid – yet again another “profit center”.

Indigo at RR MD Service Plan (May 3 2023)