Without a vote of the residents.

Without an independent forensic financial audit.

In the face of a research study that shows we don’t owe any money.

Based solely upon a vote in 2006 of 8 Brookfield employees who had an expressed conflict of interest with the future residents and could never represent their interests.

The Solterra Board announced that on Monday they will vote to issue $40 million in bonds.

$30 million to refinance the $29 million in bonds Brookfield already issued when they ran the boards.

Then using the $500,000 a year for 30 years savings from refinancing at a lower interest rate – immediately – to issue

$10 million in new bond debt (a new “loan” with interest) so the board can write a check to Brookfield for $10 million to pay for

More Brookfield profit.

After we already paid Brookfield $75.9 million in profit from the cost of our lots.

New Research Discloses Brookfield’s Double Billing for Solterra Infrastructure Costs

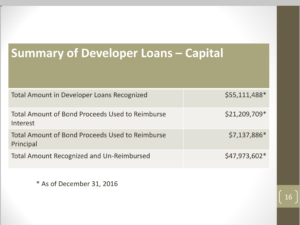

After we already paid Brookfield $21 million in interest on $7 million worth of principal when they issued the $29 million bonds from 2007 – 2016.

And all because, as the Solterra Board says in the resolution it will approve on Monday:

“B. At the 2006 Election, in accordance with law and pursuant to due notice, a majority of those qualified to vote and voting at the 2006 Election voted in favor of, inter alia, the issuance of general obligation indebtedness and the imposition of taxes for the payment thereof, for the purpose of providing certain improvements and facilities, the questions relating thereto being as follows pursuant to the ballot questions attached hereto as Exhibit A.”

The Solterra Board calls the 2006 vote: “the authorized but unissued indebtedness from the 2006 Election“.

Note that the Solterra Board does not disclose in this resolution, that the “majority of those qualified to vote” in 2006 were actually 8 Brookfield employees with an express conflict of interest with the future residents. Brookfield voting to give Brookfield lots of money and give us the bill.

In other words, in 2006 8 Brookfield employees “voted” to give the board permission to issue up to $4.9 billion in total debt to pay the principal and interest on a “loan” Brookfield gave to itself – with us paying the bill.

This is the authority the board is using to continue putting us into debt. Lots of debt.

Without a vote of the actual residents paying those taxes.

Without an independent forensic financial audit.

So, even though a majority of the Solterra residents may “vote” in the next thirty days to recall the board and oppose issuing more bond debt to pay Brookfield more money, the board doesn’t care what a majority of the residents want to do – they are going ahead and issuing more bond debt on Monday – based upon a vote, not of the residents, but a vote of 8 Brookfield employees in 2006 who will never represent the interests of a majority of the actual residents and voters of Solterra.

This behavior by the board clearly demonstrates the board does not represent the residents. They favor the vote of 8 Brookfield employees in 2006 instead of a majority of the 2000+ residents who actually live here and pay the taxes. This conduct cannot continue.

Here are some of the other things the board is doing and saying – and you are agreeing to unless you say something on Monday evening:

But first, here are a couple of things the resolution does not tell you:

a. How much of the $10 million new bond will be spent on principal and how much on interest.

This is important because the resolution also does not tell you:

b. How much more in debt will the board put the residents because Brookfield isn’t just demanding $10 million. Their demand letter in November, 2019 was for $41 + million – the most they can request under the Service Plan is $70/91 million.

The resolution doesn’t tell you, that by agreeing to pay now, you are actually agreeing to pay much more in the next year or so – up to $70/$91 million and according to Brookfield we have only paid $7 million of that amount so far. This is not the end; this is the beginning of more debt to come – and the resolution doesn’t say how much or for how much longer.

Here is what the board does say in the resolution:

1. “M. The Board has determined and does hereby determine that it is necessary and appropriate to pay the costs of the Improvement Project [the cost of developing the Solterra lots – the Solterra infrastructure] in amounts to be set forth in the Indenture.”

In other words, with no basis in fact, no evidence, no hearing, no response to the research study on the cost of the lots, no independent forensic financial audit, the Board has “decided” that it is “necessary and appropriate” to pay Brookfield more profit for the cost of the infrastructure.

“Because Brookfield says so” seems to carry more weight than an independent research report which demonstrates we already paid those costs.

2. “FF. None of the members of the Board have any potential conflicting interests in connection with the authorization, issuance, or sale of the Bonds, or the use of the proceeds thereof except to the extent that any such conflict of interest has been disclosed to the Board and to the Secretary of State, pursuant to Section 32-1-902(3), C.R.S., or except to the extent such person has abstained from taking official action thereon.”

In other words, the Solterra Board conflicts of interest have only been disclosed to . . . themselves . . . and the Secretary of State. These conflicts of interest should be disclosed to the residents.

3. “(iii). the maximum annual and total repayment cost for the Bonds shall not exceed $2,400,000 and $72,500,000 respectively”

In other words, our bill for paying the bond debt will increase from just a little over $2 million to $2.4 million each year . . . until 2050.

Since we are paying more and paying it longer, we are paying more than we are today.

And the total principal and interest we will be paying in order to pay Brookfield more profit is $72.5 million.

Without a vote of the residents.

Without an independent forensic financial audit.

4. “(a) The total aggregate amount of bonded indebtedness of the District does not now, nor shall it upon the issuance of the Bonds, exceed any applicable limit prescribed by the constitution or laws of the State of Colorado; and (b) The issuance of the Bonds, the financing of the Refunding Project, and all procedures undertaken incident thereto, are in full compliance and conformity with all applicable requirements, provisions, and limitations prescribed by the constitution and laws of the State of Colorado thereunto enabling and the District’s Service Plan.”

In other words, in 2006 the 8 Brookfield employees voted to eliminate TABOR’s application to Solterra – so in fact there are no constitutional limits.

(This is standard practice in the creation of metro districts in the Front Range. The Service Plan says the district will comply with TABOR and in the ballot issue they “comply” with TABOR by voting to eliminate TABOR’s application to the new district – eliminating the taxing limitations and the residents’ right to vote on tax/bond debt)

The only limit is what the 8 Brookfield voters “voted” on in 2006, in Brookfield’s own words, as explained in the 2016 bond prospectus:

“At the 2006 Election, the qualified electors for each of the Districts voting at such election approved indebtedness for each of the Districts of $60,000,000 for public improvements in each of 10 infrastructure categories for a total of $600,000,000 in total debt authorization for each of the Districts (excluding refunding authorization), and a maximum repayment cost for such indebtedness of $4,920,000,000 for each of the Districts.” 2016 Bond Issue, p. 61 (emphasis added)

5. “SECTION 18. Limitation of Actions. Pursuant to Section 11-57-212 of the Supplemental Act, no legal or equitable action brought with respect to any legislative acts or proceedings in connection with the authorization or issuance of the Bonds shall be commenced more than thirty days after the authorization of such securities (i.e., not more than 30 days after the approval of this Resolution). ”

In other words, you have 30 days to sue the Board if you don’t like this decision.

Or, you could tell the board “no” and make an official record of saying “no” at the meeting on Monday evening.

If there is an official record of the residents objecting, that should be made a part of the bond prospectus – because the only other authority to issue bonds is . . . 8 employees of Brookfield in 2006 . . . and your silence.

Here is the board packet which includes the draft resolutions they will vote on and here is the zoom address for Monday night at 6:30:

“First time using web-based meetings? Review this link well before the meeting (prep time: 20-mimutes) Video and audio access via computer, tablet, or mobile device, click link:

Audio access via telephone: Dail – +1 669 900 9128 | enter meeting ID – 973 8471 4270 follow prompts.

If you access via telephone only, you will be asked to provide your name by the moderator. Standard rates

and fees may apply, as charged by your carrier, based on your service.

Board Packet with Resolutions:

Solterra Board Selling Residents Down the River

John Henderson